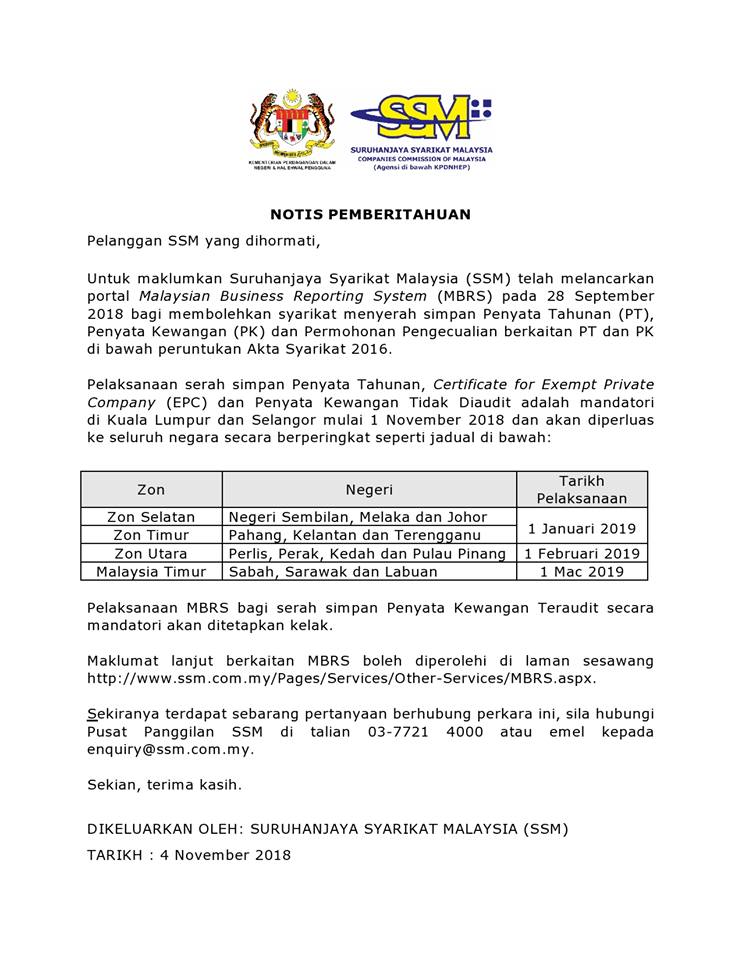

Of course this exclude the preparation of. The Annual Return is an important document that must be sent to SSM as prescribed.

The lodgement of annual return under sec 68 of the Act with SSM will cost filing fee of.

. The submission of annual returns of a company in malaysia are most important legal requirement set by companies commission of malaysia. The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia within one month after holding its AGM or in the. 1 a company shall lodge with.

Companies Act 2016. According to section 1654 companies are required to file their annual return and related forms within one month. Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016.

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the suruhanjaya syarikat malaysiassm within one. If a company has had more than one audited balance-sheet or profit and loss account or income and expenditure account since the date of the last return every balance-sheet and profit and. FORM OF ANNUAL RETURN OF A COMPANY HAVING A SHARE CAPITAL Annual return of the HAPPY FAMILY SDN.

Malaysia Companies Act 2106 Company Accounting Clauses. Annual Return comprise of all companys. All local companies Section 68 and foreign companies Section 576 registered within SSM must lodge Annual Return AR.

Under the Companies Act 2016 all registered and existing companies must lodge annual submission which comprise of. This includes Exempt Private Companies. PDF uploaded 1102018 5.

If space is insufficient a separate. An annual return is a snapshot of general information about a companys directors secretary where one has been appointed registered office address shareholders. Made up to the 31st day of December 1999 being the date of or a date not later than the fourteenth day after the date of the Annual General.

Form of annual return malaysia Pin Page Booking Holdings Inc Financials Annual Reports Congratulations Jamie Blackburn 2nd Winner Of The Our Weekly Cifc Enter To Win Contest. Made up to the 19th day of November 2011 being the. As stated in the Companies Act 2016 the Annual Return of a company must be submitted on each.

Form of annual return of a company having a share capital. Annual return of the BONA GAINS SDN. Companies Act 2016.

Malaysia Companies Act 2106 Company Auditor Clauses. Company Annual Return In Malaysia. The annual return signed by a director or by the manager or secretary of the company shall be lodged with the Suruhanjaya Syarikat Malaysia within one month from the date its AGM held.

Give the address of each place of business of the foreign company in Malaysia and if there is more than one place indicate the principal place of business. Annual return of a company.

Hockey Monkey Return Form Form Udlvirtual Edu Pe

Pdf Listed Property Companies In Malaysia A Comparative Performance Analysis

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

St Partners Plt Chartered Accountants Malaysia Ssm Duty To Lodge Annual Return Dated 31st December 2018 And Financial Statements For The Financial Year Ended 30th June 2018 Facebook

Confirmation Letter Pdf Templates Jotform

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Doc Companies Act 1965 Form Of Annual Return Of A Company Having A Share Capital Sarah Razak Academia Edu

Content Page Ssm E Lodgement Services 2 Registration Of Mygoverment Portal Public Service Portal Psp User 8 Pdf Free Download

Payments Wordpress Com Support

The Perfect Employee Evaluation Form Templates How To

Business Income Tax Malaysia Deadlines For 2021

+(b)+reminder+letter+from+ssm.png)